A career with The Insurance Center is a rewarding and fulfilling opportunity. See current openings listed below.

All locations

Sales Representative – All locations

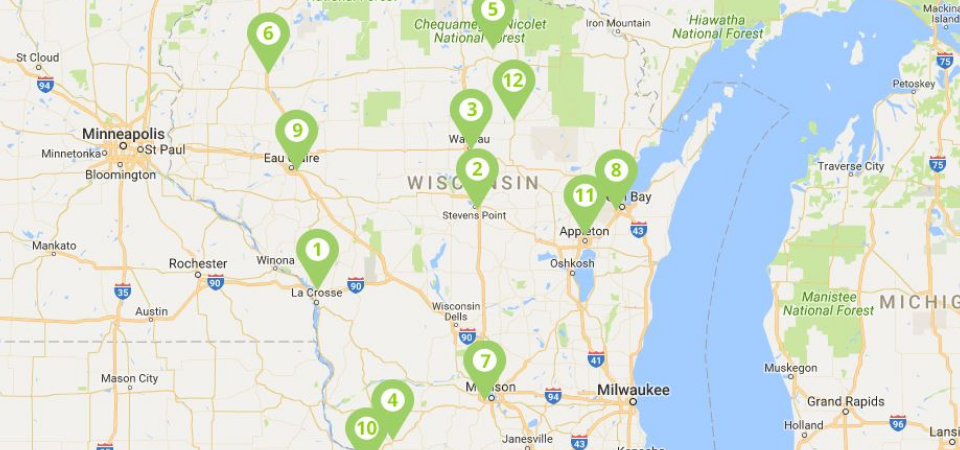

T.I.C., Inc., (The Insurance Center), a leading multi-state insurance agency, is seeking experienced Representatives to market insurance products. You must be a motivated and successful sales representative who will be responsible for servicing existing accounts and closing new accounts. We provide extensive marketing support, which includes sales lead systems, exclusive products, agency-sponsored incentive trips, competitive wage plus commission, benefits package, internal support staff and much more. We have offices throughout the states of Wisconsin, Minnesota and Iowa. Opportunities are available in the following divisions: Life, Accident & Health, Corporate Benefits and Property & Casualty.

Opportunities & training

- Culture & leadership training

- Personal & career development training

- Carrier product training

- In-house & field sales training

- Team selling

- Mentorship program

- Bignition "Wedge" outside sales training

- CE & designation support

Benefits

- Health

- Dental

- Vision

- Flexible spending plan

- Life & accidental death

- Disability

- 401k match

- Discretionary profit sharing

- Generous paid time off

- Paid holidays

- Tuition reimbursement

- Life/work balance

Compensation & incentives

- Competitive compensation

- Unlimited income potential

- New & renewal commission structures

- Treadmill/validation

- Performance-based bonus structure

- Sales incentives trips in summer & winter

Submit a resumé to T.I.C., Inc., Attn: Human Resource Department, 701 Sand Lake Road, Onalaska, WI 54650-2442. Resumés may also be submitted to jobs@ticinsurance.com. For additional information, contact the Human Resource Department at 800-362-8046 ext 30174. Equal opportunity employer.

Appleton Location

Commercial Lines Customer Service – Agent (CS-A)

The Insurance Center has an immediate opening for a Commercial Lines Customer Service – Agent (CS-A). The CS-A is responsible for the daily servicing of a book of business on assigned accounts with direct accountability for client satisfaction and retention. You will also coordinate multiple tasks across teams to meet deadlines and quality standards. We are seeking a passionate, self-driven, natural-born service person with a desire to make a difference in people's lives and businesses. As a Commercial Customer Service – Agent, you will be responsible for promoting and servicing an array of commercial property and casualty products in accordance with our established process and procedures, and in pursuit of the company's goals and objectives. You will be responsible for maintaining current client relationships. The Commercial Lines Customer Service – Agent is an effective team member and relationship builder. This is an on-site position (not remote).

Commercial Lines CS-A responsibilities

- Coordinate the servicing of a book of business with all internal and external stakeholders

- Demonstrate an advanced level of knowledge of all commercial lines of insurance

- Monitor and address aged accounts receivable with clients

- Communicate and develop relationships with clients to ensure their satisfaction with services provided

- Escalate complaints and concerns to appropriate stakeholders

- Visit clients with agent as necessary to review policies, audits, loss run analyses and projections

- Make a positive contribution to customer satisfaction and constantly strive to improve service to the customer

- Manage carrier relationships on behalf of clients to ensure the accurate and timely issuance of policies and endorsements as agreed upon

- Verify, dispute and process audit endorsements in a timely manner

- Perform detailed audit review and present to clients

Experience

- 2+ years of experience in commercial lines customer service (preferred)

- Possession of or ability to secure Property and Casualty license (must be obtained within 120 days of start date)

- Proficiency in the use of Microsoft Word and Excel required

- Willingness to expand knowledge and effectiveness in the insurance industry by successful completion of extended insurance education beyond continuing education requirements for licensing

Education

- Associates Degree and/or training equivalent experience.

The Insurance Center offers competitive compensation and excellent benefits package including 401(k) plan, medical, dental, vision, life insurance and more. Consistent with our healthy work life balance we offer paid holidays and a generous paid time off policy.

Account Support Representative- Appleton Location

The Insurance Center’s Corporate Benefits division provides benefit solutions to employers throughout WI, MN and IA as it pertains to health, dental, vision, life/AD&D, STD, Flexible Spending, COBRA administration resources, etc. In addition, we provide resources to our employer clients in the realm of compliance and other HR related support which is why candidates with an HR background are attractive. In addition, our Account Managers, Benefit Consultants and Account Support Representatives work closely with HR leaders of organizations and partner on open enrollment activities, employee onboarding as it pertains to benefits education, employee leave, and wellness programs.

The responsibilities include quoting, preparing proposals and illustrations, preparing insurance census materials, handling customer service calls from our policyholders, and assisting our producers in their marketing efforts as a valued member of a team. The successful candidate will work closely with sales agents relative to retention, client satisfaction and identify additional value-added product opportunities for existing clients and prospects.

Qualified applicants must possess strong communication skills, enjoy working in a fast paced environment and demonstrate excellent computer skills, specifically using Microsoft Word, Excel, and Outlook. Human Resources, Employee Benefits experience and/or a Life, Accident and Health Insurance License a plus! We provide competitive compensation and a complete benefits package consisting of, but not limited to, group health, dental, 401(k) plan, and generous paid time off.

Associate Stop Loss Underwriter

The Associate Stop Loss Underwriter is responsible for performing general underwriting tasks for both new and renewal business, as well as analyzing and evaluating client healthcare data for usability, ensuring its successful mapping through our pipeline, and understanding its representation on our platforms. This is an on-site position (not remote).

Responsibilities and Duties

Key Responsibilities include:

- Engage with various analytics platforms to extract, analyze, validate, and present data.

- Ensure the quality and accuracy of healthcare claims and eligibility data.

- Maintain data quality software tools to analyze data, detect errors and report anomalies.

- Interpret data to ensure accurate data deliver to consultants and clients.

- Engage with consultants and clients to answer questions and deliver data in a manner that is understandable.

- Analyze risk factors for new business and annual renewals in conformance with established underwriting standards, policies, and practices.

- Prepare a variety of reports and provide rationale and support to the Corporate Benefits consultant team.

- Calculate budget rates and evaluate a variety of contractual stop loss provisions.

- Analyze individual member risk.

- Use predictive modeling to estimate annual expected claims.

Qualifications and Skills

Minimum of an associate degree in data science/analytics, actuarial science, accounting, finance, or business and two to three years of related experience and/or training in an underwriting role; or equivalent combination of education and experience. Tech savvy with data visualization experience. Above average proficiency and knowledge of Word, Excel, Outlook, internet navigation and a variety of database platforms required. IT-related experience preferred with strong problem-solving skills. Excellent problem solving and critical thinking skills. High level of curiosity with ability to conduct and present self-directed research. Strong ability to analyze and visualize data. Employee benefits knowledge and self-funding a plus.

Eau Claire Location

Commercial Lines Customer Service – Agent (CS-A)

The Insurance Center has an immediate opening for a Commercial Lines Customer Service – Agent (CS-A). The CS-A is responsible for the daily servicing of a book of business on assigned accounts with direct accountability for client satisfaction and retention. You will also coordinate multiple tasks across teams to meet deadlines and quality standards. We are seeking a passionate, self-driven, natural-born service person with a desire to make a difference in people's lives and businesses. As a Commercial Customer Service – Agent, you will be responsible for promoting and servicing an array of commercial property and casualty products in accordance with our established process and procedures, and in pursuit of the company's goals and objectives. You will be responsible for maintaining current client relationships. The Commercial Lines Customer Service – Agent is an effective team member and relationship builder. This is an on-site position (not remote).

Commercial Lines CS-A responsibilities

- Coordinate the servicing of a book of business with all internal and external stakeholders

- Demonstrate an advanced level of knowledge of all commercial lines of insurance

- Monitor and address aged accounts receivable with clients

- Communicate and develop relationships with clients to ensure their satisfaction with services provided

- Escalate complaints and concerns to appropriate stakeholders

- Visit clients with agent as necessary to review policies, audits, loss run analyses and projections

- Make a positive contribution to customer satisfaction and constantly strive to improve service to the customer

- Manage carrier relationships on behalf of clients to ensure the accurate and timely issuance of policies and endorsements as agreed upon

- Verify, dispute and process audit endorsements in a timely manner

- Perform detailed audit review and present to clients

Experience

- 2+ years of experience in commercial lines customer service (preferred)

- Possession of or ability to secure Property and Casualty license (must be obtained within 120 days of start date)

- Proficiency in the use of Microsoft Word and Excel required

- Willingness to expand knowledge and effectiveness in the insurance industry by successful completion of extended insurance education beyond continuing education requirements for licensing

Education

- Associates Degree and/or training equivalent experience.

The Insurance Center offers competitive compensation and excellent benefits package including 401(k) plan, medical, dental, vision, life insurance and more. Consistent with our healthy work life balance we offer paid holidays and a generous paid time off policy.

Green Bay Location

Commercial Lines Customer Service – Agent (CS-A) – Green Bay location

The Insurance Center has an immediate opening for a Commercial Lines Customer Service – Agent (CS-A) in the Green Bay, Wisconsin area. The CS-A is responsible for the daily servicing of a book of business on assigned accounts with direct accountability for client satisfaction and retention. You will also coordinate multiple tasks across teams to meet deadlines and quality standards. We are seeking a passionate, self-driven, natural-born service person with a desire to make a difference in people's lives and businesses. As a Commercial Customer Service – Agent, you will be responsible for promoting and servicing an array of commercial property and casualty products in accordance with our established process and procedures, and in pursuit of the company's goals and objectives. You will be responsible for maintaining current client relationships. The Commercial Lines Customer Service – Agent is an effective team member and relationship builder. This is an on-site position (not remote).

Commercial Lines CS-A responsibilities

- Coordinate the servicing of a book of business with all internal and external stakeholders

- Demonstrate an advanced level of knowledge of all commercial lines of insurance

- Monitor and address aged accounts receivable with clients

- Communicate and develop relationships with clients to ensure their satisfaction with services provided

- Escalate complaints and concerns to appropriate stakeholders

- Visit clients with agent as necessary to review policies, audits, loss run analyses and projections

- Make a positive contribution to customer satisfaction and constantly strive to improve service to the customer

- Manage carrier relationships on behalf of clients to ensure the accurate and timely issuance of policies and endorsements as agreed upon

- Verify, dispute and process audit endorsements in a timely manner

- Perform detailed audit review and present to clients

Experience

- 2+ years of experience in commercial lines customer service (required)

- Possession of or ability to secure Property and Casualty license (must be obtained within 120 days of start date)

- Proficiency in the use of Microsoft Word and Excel required

- Willingness to expand knowledge and effectiveness in the insurance industry by successful completion of extended insurance education beyond continuing education requirements for licensing

Education

- Bachelor's degree from an accredited college or university (preferred)

Associate Stop Loss Underwriter

The Associate Stop Loss Underwriter is responsible for performing general underwriting tasks for both new and renewal business, as well as analyzing and evaluating client healthcare data for usability, ensuring its successful mapping through our pipeline, and understanding its representation on our platforms. This is an on-site position (not remote).

Responsibilities and Duties

Key Responsibilities include:

- Engage with various analytics platforms to extract, analyze, validate, and present data.

- Ensure the quality and accuracy of healthcare claims and eligibility data.

- Maintain data quality software tools to analyze data, detect errors and report anomalies.

- Interpret data to ensure accurate data deliver to consultants and clients.

- Engage with consultants and clients to answer questions and deliver data in a manner that is understandable.

- Analyze risk factors for new business and annual renewals in conformance with established underwriting standards, policies, and practices.

- Prepare a variety of reports and provide rationale and support to the Corporate Benefits consultant team.

- Calculate budget rates and evaluate a variety of contractual stop loss provisions.

- Analyze individual member risk.

- Use predictive modeling to estimate annual expected claims.

Qualifications and Skills

Minimum of an associate degree in data science/analytics, actuarial science, accounting, finance, or business and two to three years of related experience and/or training in an underwriting role; or equivalent combination of education and experience. Tech savvy with data visualization experience. Above average proficiency and knowledge of Word, Excel, Outlook, internet navigation and a variety of database platforms required. IT-related experience preferred with strong problem-solving skills. Excellent problem solving and critical thinking skills. High level of curiosity with ability to conduct and present self-directed research. Strong ability to analyze and visualize data. Employee benefits knowledge and self-funding a plus.

Account Support Representative

The Insurance Center is a successful and well-established independent insurance agency seeking a dependable and hardworking individual to join our team. As an Account Support Representative, you will provide accurate, efficient and timely support and service for assigned clients. The Insurance Center is committed to providing a diverse and challenging work environment encouraging critical thinking and problem solving.

Key responsibilities include:

- Build and maintain a strong relationship with our clients and carriers by responding to issues relating to questions on policies, coverages, claims and accounting and billing

- Assist with marketing new and renewal business and processing enrollment paperwork

- Maintain insured's information in various systems

- Participate in client annual enrollment meetings

- Provide prompt and friendly account support

- Multi-task, organize and perform tasks accurately

Required experience Qualified applicants must possess strong communication skills, enjoy working in a fast-paced environment and demonstrate excellent computer skills, specifically using Microsoft Word, Excel and Outlook. Human Resources, Employee Benefits experience and/or a Life, Accident and Health Insurance License a plus. The Insurance Center offers competitive compensation and excellent benefits package including 401(k) plan, medical, dental, vision, life insurance and more. Consistent with our healthy work/life balance, we offer paid holidays and a generous paid time off policy.

Onalaska Location

Commercial Lines Customer Service – Agent (CS-A)

The Insurance Center has an immediate opening for a Commercial Lines Customer Service – Agent (CS-A). The CS-A is responsible for the daily servicing of a book of business on assigned accounts with direct accountability for client satisfaction and retention. You will also coordinate multiple tasks across teams to meet deadlines and quality standards. We are seeking a passionate, self-driven, natural-born service person with a desire to make a difference in people's lives and businesses. As a Commercial Customer Service – Agent, you will be responsible for promoting and servicing an array of commercial property and casualty products in accordance with our established process and procedures, and in pursuit of the company's goals and objectives. You will be responsible for maintaining current client relationships. The Commercial Lines Customer Service – Agent is an effective team member and relationship builder. This is an on-site position (not remote).

Commercial Lines CS-A responsibilities

- Coordinate the servicing of a book of business with all internal and external stakeholders

- Demonstrate an advanced level of knowledge of all commercial lines of insurance

- Monitor and address aged accounts receivable with clients

- Communicate and develop relationships with clients to ensure their satisfaction with services provided

- Escalate complaints and concerns to appropriate stakeholders

- Visit clients with agent as necessary to review policies, audits, loss run analyses and projections

- Make a positive contribution to customer satisfaction and constantly strive to improve service to the customer

- Manage carrier relationships on behalf of clients to ensure the accurate and timely issuance of policies and endorsements as agreed upon

- Verify, dispute and process audit endorsements in a timely manner

- Perform detailed audit review and present to clients

Experience

- 2+ years of experience in commercial lines customer service (preferred)

- Possession of or ability to secure Property and Casualty license (must be obtained within 120 days of start date)

- Proficiency in the use of Microsoft Word and Excel required

- Willingness to expand knowledge and effectiveness in the insurance industry by successful completion of extended insurance education beyond continuing education requirements for licensing

Education

- Associates Degree and/or training equivalent experience.

The Insurance Center offers competitive compensation and excellent benefits package including 401(k) plan, medical, dental, vision, life insurance and more. Consistent with our healthy work life balance we offer paid holidays and a generous paid time off policy.

Associate Stop Loss Underwriter

The Associate Stop Loss Underwriter is responsible for performing general underwriting tasks for both new and renewal business, as well as analyzing and evaluating client healthcare data for usability, ensuring its successful mapping through our pipeline, and understanding its representation on our platforms. This is an on-site position (not remote).

Responsibilities and Duties

Key Responsibilities include:

- Engage with various analytics platforms to extract, analyze, validate, and present data.

- Ensure the quality and accuracy of healthcare claims and eligibility data.

- Maintain data quality software tools to analyze data, detect errors and report anomalies.

- Interpret data to ensure accurate data deliver to consultants and clients.

- Engage with consultants and clients to answer questions and deliver data in a manner that is understandable.

- Analyze risk factors for new business and annual renewals in conformance with established underwriting standards, policies, and practices.

- Prepare a variety of reports and provide rationale and support to the Corporate Benefits consultant team.

- Calculate budget rates and evaluate a variety of contractual stop loss provisions.

- Analyze individual member risk.

- Use predictive modeling to estimate annual expected claims.

Qualifications and Skills

Minimum of an associate degree in data science/analytics, actuarial science, accounting, finance, or business and two to three years of related experience and/or training in an underwriting role; or equivalent combination of education and experience. Tech savvy with data visualization experience. Above average proficiency and knowledge of Word, Excel, Outlook, internet navigation and a variety of database platforms required. IT-related experience preferred with strong problem-solving skills. Excellent problem solving and critical thinking skills. High level of curiosity with ability to conduct and present self-directed research. Strong ability to analyze and visualize data. Employee benefits knowledge and self-funding a plus.

Client Software Specialist

Are you a confident, team oriented individual with outstanding technology skills and attention to detail? The Insurance Center is currently searching for a candidate with these qualities to join our team as a Client Software Specialist. This is an on-site position (not remote) located in our Onalaska, WI location. The Client Software Specialist is responsible for troubleshooting and resolving tickets representing client software-related requests in the Employee Navigator platform. This position also provides ongoing support and maintenance for existing clients, sales relationships, and administration.

Responsibilities:

- Become an expert within all facets of the Employee Navigator platform through departmental and independent hands-on training.

- Provide the first line of support for our customer base via email or phone.

- Assist with case builds including benefits enrollment, carrier and payroll integrations and employee onboarding.

- Update and maintain benefit administration platform, benefits, and structure changes.

- Work with carriers and clients to resolve enrollment and eligibility issues.

- Perform testing on benefit administration platform prior to deployment to proactively discover potential errors.

- Conduct webinar and in person demonstrations and/or trainings.

- Create and maintain training guides.

- Provide systematic status updates to the client and/or internal team members regarding enrollment status.

Required Qualifications:

- Associates degree and two to three years of related experience and/or training; or equivalent combination of education and experience.

- Possess innate customer service skills including the ability to be empathetic, accurate, compassionate, responsive, resourceful, and conscientious.

- Expertly address challenging questions while providing answers that are quick and easy to understand.

- Consistently seek to improve their own knowledge, the customer’s knowledge, and the product itself.

- Be a motivated problem solver who can accurately document and communicate issues.

- Demonstrate proficiency using Microsoft Office products, including Excel.

- Availability and willingness for occasional travel to outside client, meeting or conference.

- Valid Wisconsin driver's license and reliable transportation

- Willingness to secure WI Life, Health & Accident Insurance License.

Preferred Qualifications:

- Proficiency and experience with benefit administration platforms and presentation technologies.

- Knowledge of employee benefits and tax advantaged benefit programs

- Previous experience in Human Resources and HRIS Systems, Benefits Administration, working with insurance brokers and/or carriers or in the health insurance industry.

Sales Support Specialist

The Insurance Center is a successful and well-established independent insurance agency seeking a dependable and hardworking individual to join our team. As a Sales Support Specialist you will provide accurate, efficient & timely support and service for our clients. The Insurance Center is committed to providing a diverse and challenging work environment encouraging critical thinking and problem solving.

Key Responsibilities include:

- Building and maintaining a strong relationship with our clients and carriers by responding to issues relating to questions on policies, coverages, claims and accounting and billing.

- Assist with marketing new and renewal business and processing enrollment paperwork.

- Maintain insured’s information in various systems.

- Providing prompt and friendly account support.

- The ability to multi-task, organize and perform work with accuracy.

Required Experience:

Qualified applicants must possess strong communication skills, enjoy working in a fast-paced environment and demonstrate excellent computer skills, specifically using Microsoft Word, Excel, and Outlook. Prior Life and Health insurance experience and/or a Life, Accident and Health Insurance License a plus!

Stevens Point Location

Life & Health Sales Representative

Life and Health Sales Representative

T.I.C., Inc., (The Insurance Center), a leading multi-state insurance agency, is seeking experienced Sales Representatives to market insurance products throughout Northcentral Wisconsin. You must be a motivated and successful sales representative who will be responsible for servicing existing accounts and closing new accounts. We provide extensive marketing support, which includes sales lead systems, exclusive products, agency-sponsored incentive trips, competitive wage plus commission, benefits package, internal support staff and much more.

Opportunities & training

- Culture & leadership training

- Personal & career development training

- Carrier product training

- In-house & field sales training

- Team selling

- Mentorship program

- Bignition "Wedge" outside sales training

- CE & designation support

Commercial Lines Customer Service – Agent (CS-A)

The Insurance Center has an immediate opening for a Commercial Lines Customer Service – Agent (CS-A). The CS-A is responsible for the daily servicing of a book of business on assigned accounts with direct accountability for client satisfaction and retention. You will also coordinate multiple tasks across teams to meet deadlines and quality standards. We are seeking a passionate, self-driven, natural-born service person with a desire to make a difference in people's lives and businesses. As a Commercial Customer Service – Agent, you will be responsible for promoting and servicing an array of commercial property and casualty products in accordance with our established process and procedures, and in pursuit of the company's goals and objectives. You will be responsible for maintaining current client relationships. The Commercial Lines Customer Service – Agent is an effective team member and relationship builder. This is an on-site position (not remote).

Commercial Lines CS-A responsibilities

- Coordinate the servicing of a book of business with all internal and external stakeholders

- Demonstrate an advanced level of knowledge of all commercial lines of insurance

- Monitor and address aged accounts receivable with clients

- Communicate and develop relationships with clients to ensure their satisfaction with services provided

- Escalate complaints and concerns to appropriate stakeholders

- Visit clients with agent as necessary to review policies, audits, loss run analyses and projections

- Make a positive contribution to customer satisfaction and constantly strive to improve service to the customer

- Manage carrier relationships on behalf of clients to ensure the accurate and timely issuance of policies and endorsements as agreed upon

- Verify, dispute and process audit endorsements in a timely manner

- Perform detailed audit review and present to clients

Experience

- 2+ years of experience in commercial lines customer service (preferred)

- Possession of or ability to secure Property and Casualty license (must be obtained within 120 days of start date)

- Proficiency in the use of Microsoft Word and Excel required

- Willingness to expand knowledge and effectiveness in the insurance industry by successful completion of extended insurance education beyond continuing education requirements for licensing

Education

- Associates Degree and/or training equivalent experience.

The Insurance Center offers competitive compensation and excellent benefits package including 401(k) plan, medical, dental, vision, life insurance and more. Consistent with our healthy work life balance we offer paid holidays and a generous paid time off policy.

Associate Stop Loss Underwriter

The Associate Stop Loss Underwriter is responsible for performing general underwriting tasks for both new and renewal business, as well as analyzing and evaluating client healthcare data for usability, ensuring its successful mapping through our pipeline, and understanding its representation on our platforms. This is an on-site position (not remote).

Responsibilities and Duties

Key Responsibilities include:

- Engage with various analytics platforms to extract, analyze, validate, and present data.

- Ensure the quality and accuracy of healthcare claims and eligibility data.

- Maintain data quality software tools to analyze data, detect errors and report anomalies.

- Interpret data to ensure accurate data deliver to consultants and clients.

- Engage with consultants and clients to answer questions and deliver data in a manner that is understandable.

- Analyze risk factors for new business and annual renewals in conformance with established underwriting standards, policies, and practices.

- Prepare a variety of reports and provide rationale and support to the Corporate Benefits consultant team.

- Calculate budget rates and evaluate a variety of contractual stop loss provisions.

- Analyze individual member risk.

- Use predictive modeling to estimate annual expected claims.

Qualifications and Skills

Minimum of an associate degree in data science/analytics, actuarial science, accounting, finance, or business and two to three years of related experience and/or training in an underwriting role; or equivalent combination of education and experience. Tech savvy with data visualization experience. Above average proficiency and knowledge of Word, Excel, Outlook, internet navigation and a variety of database platforms required. IT-related experience preferred with strong problem-solving skills. Excellent problem solving and critical thinking skills. High level of curiosity with ability to conduct and present self-directed research. Strong ability to analyze and visualize data. Employee benefits knowledge and self-funding a plus.

Wausau Location

Life & Health Sales Representative

Life and Health Sales Representative

T.I.C., Inc., (The Insurance Center), a leading multi-state insurance agency, is seeking experienced Sales Representatives to market insurance products throughout Northcentral Wisconsin. You must be a motivated and successful sales representative who will be responsible for servicing existing accounts and closing new accounts. We provide extensive marketing support, which includes sales lead systems, exclusive products, agency-sponsored incentive trips, competitive wage plus commission, benefits package, internal support staff and much more.

Opportunities & training

- Culture & leadership training

- Personal & career development training

- Carrier product training

- In-house & field sales training

- Team selling

- Mentorship program

- Bignition "Wedge" outside sales training

- CE & designation support

Associate Stop Loss Underwriter

The Associate Stop Loss Underwriter is responsible for performing general underwriting tasks for both new and renewal business, as well as analyzing and evaluating client healthcare data for usability, ensuring its successful mapping through our pipeline, and understanding its representation on our platforms. This is an on-site position (not remote).

Responsibilities and Duties

Key Responsibilities include:

- Engage with various analytics platforms to extract, analyze, validate, and present data.

- Ensure the quality and accuracy of healthcare claims and eligibility data.

- Maintain data quality software tools to analyze data, detect errors and report anomalies.

- Interpret data to ensure accurate data deliver to consultants and clients.

- Engage with consultants and clients to answer questions and deliver data in a manner that is understandable.

- Analyze risk factors for new business and annual renewals in conformance with established underwriting standards, policies, and practices.

- Prepare a variety of reports and provide rationale and support to the Corporate Benefits consultant team.

- Calculate budget rates and evaluate a variety of contractual stop loss provisions.

- Analyze individual member risk.

- Use predictive modeling to estimate annual expected claims.

Qualifications and Skills

Minimum of an associate degree in data science/analytics, actuarial science, accounting, finance, or business and two to three years of related experience and/or training in an underwriting role; or equivalent combination of education and experience. Tech savvy with data visualization experience. Above average proficiency and knowledge of Word, Excel, Outlook, internet navigation and a variety of database platforms required. IT-related experience preferred with strong problem-solving skills. Excellent problem solving and critical thinking skills. High level of curiosity with ability to conduct and present self-directed research. Strong ability to analyze and visualize data. Employee benefits knowledge and self-funding a plus.

Future Opportunities at The Insurance Center

Future Opportunities at T.I.C.

We understand that your dream job may not be listed right now, but we believe in creating opportunities for the right candidates. We are seeking passionate, driven, and versatile individuals who are interested in being considered for future roles at The Insurance Center. While we may not have the perfect role for you right now, we are constantly evolving and growing, which means new opportunities are always on the horizon. By applying for this position, you will be considered for future job openings that align with your skills, experience, and career aspirations.

Submit your resume along with a cover letter explaining why you're interested in future opportunities with us. Tell us about your skills, experiences, and areas of interest. We're excited to learn more about you and will reach out when roles that match your profile become available.

As an Equal Opportunity Employer, T.I.C., Inc. will recruit and select applicants for employment solely on the basis of their qualifications. Our Practices and Procedures, including those relating to wages, benefits, transfers, promotions, terminations and self-development opportunities, will be administered without regard to race, color, religion, sex, sexual orientation and gender identity, age, national origin, disability, or protected veteran status and all other classes protected by the Federal and State Government.

For consideration, submit a letter of application, resumé, and salary history to: jobs@ticinsurance.com. Please sure to specify which opening you are interested in.

Located exactly where you need us to be. In your backyard.

By having locations throughout Wisconsin (and an office in Iowa), an Insurance Center neighborhood insurance agent is able to provide a superior level of customer service. It’s convenient for you and important to us; we want to be ready to assist people in our communities when you need us.